Borrow Money in Singapore (2026)

A Safe & Legal Guide to Borrowing Money Online

A Safe & Legal Way to Borrow Money — Know Your Options

Borrowing money in Singapore is legal when done through the right channels. If you’re considering taking a loan, it’s important to understand where to borrow safely, what your options are, and what to look out for before committing.

This page explains the essentials of borrowing money in Singapore and helps you decide the right next step, without pressure.

Is It Legal to Borrow Money in Singapore?

Yes. Borrowing money is legal only when done through:

Banks

Licensed moneylenders regulated by the Ministry of Law

Borrowing from unlicensed moneylenders (loan sharks) is illegal and carries serious financial and personal risks.

PickMeALoan works only with licensed and regulated lenders.

Where Can You Borrow Money in Singapore?

The standard process used by fast cash providers.

Banks

Typically offer lower interest rates

Stricter eligibility criteria

Longer approval timelines

Best suited for borrowers with stable income and good credit profiles.

Licensed Moneylenders

Faster approval processes

Smaller loan amounts

Regulated under Singapore law

Often considered by borrowers who need funds sooner or do not meet bank requirements.

Unlicensed Moneylenders (Avoid)

Illegal

No consumer protection

Risk of harassment or unfair practices

If an offer sounds too easy or bypasses regulations, it is likely unsafe.

What to Consider Before Borrowing Money

- Borrow only what you need and can afford to repay

- Ensure you understand the repayment schedule, interest, and fees

- Do not rush into signing a loan contract

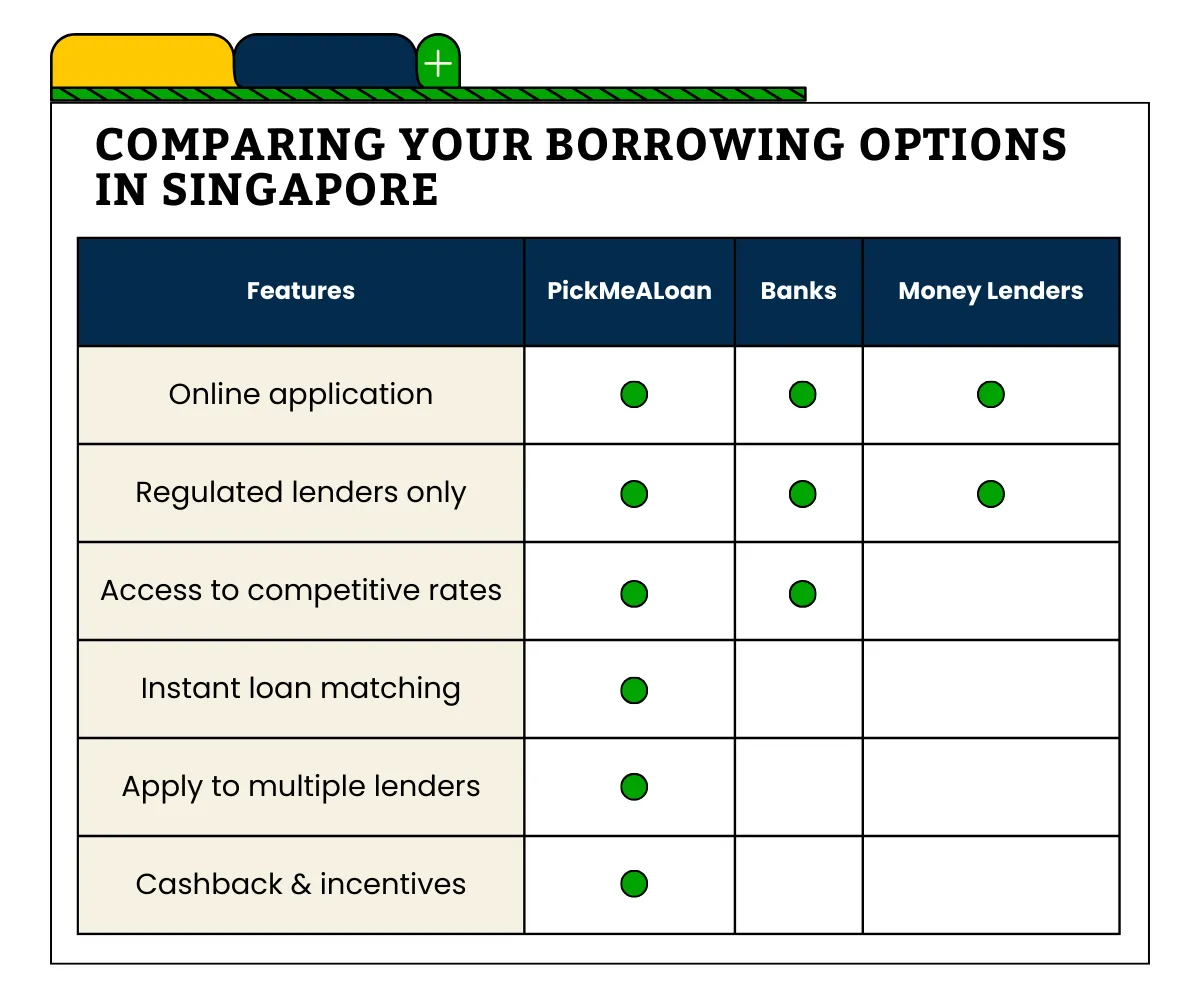

Why many borrowers now use PickMeALoan instead:

- Compare multiple lenders at once

- Instant pre-checks without affecting credit score

- See your estimated rates and loan amounts upfront

- Offers delivered quickly through WhatsApp

Current Personal Loan Market Snapshot (Singapore 2026)

Updated with the latest publicly available fast cash provider benchmarks.

| Lender Type | Typical Interest Rate | EIR (Effective Interest Rate) | Approval Speed | Notes |

|---|---|---|---|---|

| Banks | ~3.0% – 12.0% annually | ~6.5% – 13% | 1–3 days | Lower interest, stricter eligibility |

| Fast Cash Providers | ~4.0% monthly | Varies (depends on fees & tenure) | Same day | More flexible, faster approval |

| Lendela | ~3.0% – 4.0% monthly | Varies by lender | Same day | One application → multiple options |

| LendingPot | ~3.0% – 4.0% monthly | Varies by lender | Same day | One application → multiple lenders |

| Roshi | ~3.0% – 4.0% monthly | Varies by lender | Same day | Compares bank + moneylender options |

| PickMeALoan | ~1.0% – 3.0% monthly | Varies by lender | Minutes | Lowest rates • Price matching • AI-powered matching • Discreet & private • PDPA-compliant |

Disclaimer: Actual rates depend on income, credit profile, existing loans, and fast cash provider risk policies.

How Much Can You Borrow from Licensed Moneylenders?

For unsecured loans, borrowing limits are regulated and depend on your income level and residency status.

In general:

Lower-income borrowers have capped limits

Higher-income borrowers may borrow up to 6 times their monthly income

Limits apply across all licensed moneylenders combined

Actual loan amounts depend on lender assessment and regulations.

Can You Borrow Money Online in Singapore?

Yes — but the online experience depends on the type of lender.

Banks: You can complete the entire loan application online, from submission to approval and disbursement, subject to verification checks.

Licensed Moneylenders: Many allow you to begin your application online and receive a preliminary decision, but they are required to meet you in person at their approved place of business for identity verification before they can grant and disburse your loan

Licensed moneylenders cannot conduct the full loan transaction entirely online without this face-to-face step, as mandated by law.

Using a platform like PickMeALoan lets you review and compare options online first, then complete the required steps with the lender you choose.

What Affects the Interest Rate You May Be Offered?

There is no single “lowest interest rate” that applies to everyone. The interest rate you may be offered depends on factors such as:

Income level and employment stability

Existing financial commitments

Loan amount and repayment tenure

The lender’s internal assessment criteria

Different lenders assess borrowers differently, which is why offers can vary.

If you wish to explore available options, you can compare suitable loan offers based on your profile.

How to Borrow Money Through PickMeALoan (Fast & Simple)

Tell us what you need

Securely connect with Singpass or answer three quick questions about your loan request.

Our AI system analyses your profile privately to understand your eligibility.

Instant Loan Matches

Our AI-managed system instantly identifies the best fast cash provider for your profile.

lowest eligible interest rate

longest possible tenure

highest realistic loan amount

Review & Proceed Privately

We’ll send your personalised offers directly via WhatsApp.

Choose the option that suits you best — no pressure, no calls, no judgement.

We coordinate the final steps, and many providers offer same-day disbursement once verification is complete.

No need to return to the site — everything continues seamlessly through WhatsApp.

Ready to get your personalised loan offers?

100% free · No obligation

What our customers are saying..

Testimonials from our satisfied clients.

What Is the Right Next Step for You?

PickMeALoan helps guide borrowers by explaining options clearly and working only with licensed lenders.

Depending on your situation, you may find these helpful:

Frequently Asked Questions

Clear answers to help you secure the best personal loan deals in Singapore.

Is it legal to borrow money in Singapore?

Yes. Borrowing money is legal when done through banks or licensed moneylenders regulated by the Ministry of Law. Borrowing from unlicensed lenders is illegal and should be avoided.

Where can I legally borrow money in Singapore?

You can legally borrow money from:

- Banks

- Licensed moneylenders listed on the Ministry of Law’s registry

PickMeALoan works only with licensed and regulated lenders.

How much money can I borrow?

The amount you can borrow depends on:

- Your income level

- Employment status

- Residency status

- Lender-specific criteria

Different lenders have different limits. Applying helps you see what you are eligible for, without obligation.

Can I borrow money if I have bad or average credit?

Yes, it may still be possible. Some licensed moneylenders consider:

- Income stability

- Employment history

- Overall affordability

Eligibility varies by lender, which is why matching matters.

Should I borrow from a bank or a licensed moneylender?

It depends on your situation:

- Banks generally offer lower interest rates but stricter approval

- Licensed moneylenders may approve faster with more flexible criteria

PickMeALoan helps you understand your options so you can decide responsibly.

What documents are usually required to borrow money?

Most lenders require:

- NRIC or identification

- Proof of income (e.g. payslip)

- Employment details

Some lenders may request additional documents.

Will applying affect my credit score?

Viewing loan options typically does not affect your credit score. A lender may conduct checks if you choose to proceed with an application.

Are there hidden fees when borrowing money?

Licensed lenders are regulated and must follow rules on:

- Interest rates

- Fees

- Loan disclosures

Always review loan terms carefully before accepting any offer.

How fast can I receive the money?

Approval and disbursement times vary.

Some licensed moneylenders may approve and disburse funds on the same day, after verification.

What happens after I apply on PickMeALoan?

After you apply:

- Your information is used only for loan matching

- You receive suitable lender options

- You decide whether to proceed

You are not obligated to accept any loan offer.

Is PickMeALoan a lender?

No. PickMeALoan is a loan comparison and matching platform, not a lender.

Is PickMeALoan free to use?

Yes. PickMeALoan is free for borrowers.

Skip the Hard Work! We Match You Instantly.

Tell us what you need and we’ll negotiate the best loan options on your behalf in minutes.

About PickMeALoan

Popular Guides

Other Guides

Socials

Copyright 2026. PickMeALoan. All Rights Reserved.